Our experts use their international market competence to support you personally and individually on your projects. Through the supervision of cooperative institutions, you benefit from a group with 60 years of experience as a stable banking group with a top rating and sustainable business model.

As part of the FONDSHAFEN initiative, we have joined forces with the asset servicing specialists of the Volksbanken Raiffeisenbanken cooperative financial network to meet your needs. If you are looking for a custodian in Germany, Luxembourg or Switzerland, would like to launch a new fund or are looking for a partner to manage your custody account, then you have come to the right place! You can find further information at https://www.fondshafen.de/

- Depositary functions in Germany, Luxembourg and Switzerland for mutual and special funds

- Modern and scalable depository platform for all relevant fund markets

- Technical setup and expert knowledge for securities, alternative investments and real estate funds

- ManCo-independent processes through our own custodian system for fund accounting, investment limit checks and cash flow control

- Add-on services (e.g. liquidity management, auto-FX, withholding tax services)

Proprietary investment portfolios for fund holdings and direct holdings

For institutional investors, family offices, and banks, DZ BANK manages proprietary investment portfolios for fund and direct holdings. The diverse range of services supports your investment and back office areas. You benefit from highly-trained personnel and our range of products tailored to the requirements of customers from German-speaking countries.

- Custody and transaction processing

- Mapping of complex portfolio structures

- Clearing & settlement of securities and derivatives

- Safekeeping and administration of debenture bonds

- Support with reporting

- Extensive withholding tax services

- Information and ticket ordering for the general meetings of German corporations

Board of Directors and Management

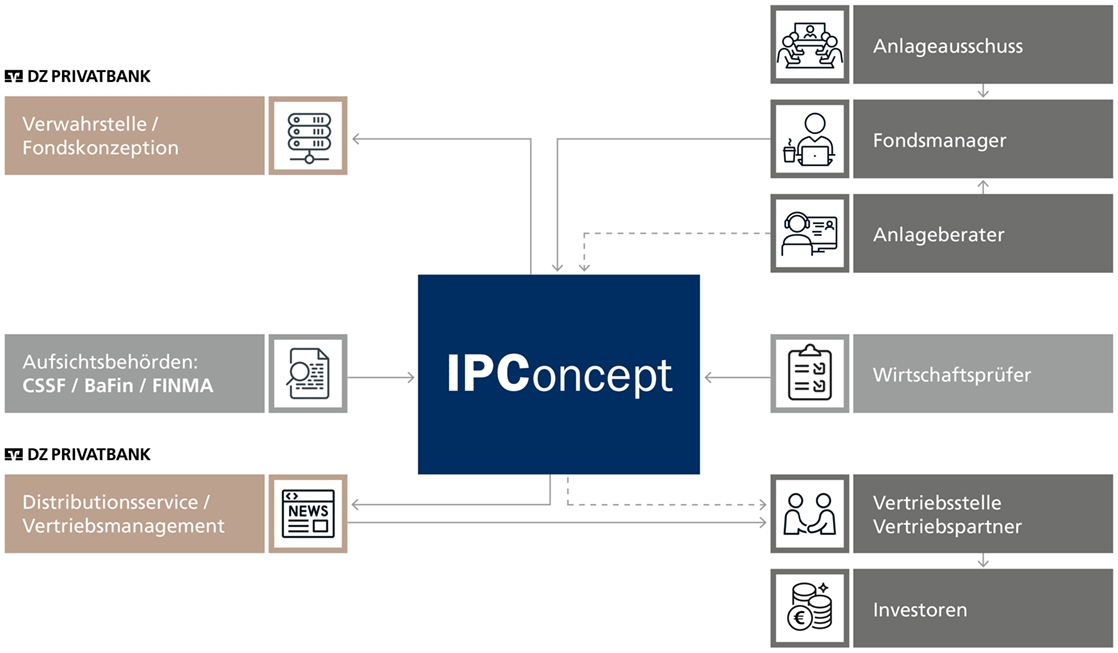

Founded in 2001, IPConcept (Luxemburg) S.A. is a 100 percent subsidiary of DZ PRIVATBANK S.A. and offers asset managers and family offices the opportunity to realize their own individual and creative fund concepts.

Organizational chart IPConcept Luxemburg (JPEG)

Board

IPConcept (Schweiz) AG offers fund initiators fund management, fund representation and sales support services. Furthermore, IPConcept (Schweiz) AG can draw on the entire range of services of the IPConcept Group at all times and therefore offers fund initiators access and a bridge to the European fund market.

Organizational chart IPConcept Schweiz (JPEG)

Management

Our responsibility

Our association with the cooperative tradition represents not only our mission to contribute in the best interests of society, but also to specifically address global problems – such as climate change and resource scarcity, poverty and demographic change, spatial development, deforestation and the threat to biodiversity.

DZ BANK Group: "Eminently sustainable"

Oekom Research, one of the world's leading rating agencies in the sustainable investment market, has repeatedly awarded the DZ BANK Group a “C +” rating. It therefore continues to be listed with "Prime Status" for especially sustainable companies. Its current rating makes the DZ BANK Group one of the top-ranked German banks. (As of February 2018)

Live sustainability

Like DZ PRIVATBANK, we have been committed to integrating facets of sustainability into the company since 2012 as part of the sustainability market initiative that was initiated by the DZ BANK Group.

Since then, we have drawn up joint guidelines for our suppliers and service providers in order to also assess them on social and ecological issues. A common code of conduct provides the basis for employees of the DZ BANK Group. In future, too, we will jointly strive to further extend sustainability-related activities. For our business partners, this specifically means expansion or further development of services offered.

Through environmental management that realizes energy-efficient solutions in building technology, we are pursuing a common climate target with an aim and minimum requirement: starting from the base year 2009, companies in the DZ BANK Group will reduce their respective CO2 emissions by at least 80 percent by 2050.

Your career with us

Who we are?

Reliability, partnership and initiative – for our customers, for our employees. These are our values.

IPConcept is part of the cooperative financial network, with its network of cooperative banks. We are specialists in this network for the launch of private label and alternative investment funds. As well as third-party fund companies, our customers include family offices, asset managers, insurance companies and banks.

This means our tasks are demanding, qualified and varied. And internationally oriented – alone because of our offices in Luxembourg, Germany and Switzerland.

What do we offer?

First and foremost, the facts are what make us such an attractive employer. We are the capital management company with the largest number of customers in the German-speaking market – that includes Luxembourg, which is not only located in the heart of Europe but is also one of the world's leading centres for fund standards.

Secondly, our employees value the working conditions and the extras we offer. We offer our employees flexitime models with flexible working hours so that they can combine work and leisure as they wish. And we offer the Geno pension fund as a secure / additional retirement provision, company health management, sports activities, a canteen with a wide selection, free parking and the option of mobile work.

IPConcept offers you an attractive workplace in an attractive environment. You will find our job advertisements here.